The question of how to calculate inflation rate using CPI is fundamental to finance and economics. Inflation, the slow, relentless increase in the cost of goods and services, silently erodes the purchasing power of your money over time. Without knowing the accurate inflation rate, you can’t truly measure wealth, plan for retirement, or even understand what a salary from ten years ago is worth today.

This comprehensive guide is designed to empower you. We will break down the complex CPI data formula, provide a simple, step-by-step calculation process, explore the real-world scenarios where this number is essential, and show you how to automate this process instantly with a powerful online tool.

By the end of this article, you will not only know how to calculate inflation rate using CPI, but you will understand the concept of real value and why it’s the only metric that truly matters.

The Foundation: Understanding the Consumer Price Index (CPI)

The key to unlocking the inflation rate is the Consumer Price Index (CPI). The CPI is not just an arbitrary number; it is the single most important gauge of consumer prices in an economy.

What Exactly is the CPI?

The CPI is a measure of the average change over time in the prices paid by urban consumers for a standardized “market basket” of consumer goods and services. This basket is meticulously tracked and includes essential items like food and beverages, housing, apparel, transportation, medical care, recreation, education, and communication.

- When the CPI rises: It indicates that the average cost of this basket has increased, meaning that money buys less—this is inflation.

- When the CPI falls (rarely): It indicates that the average cost has decreased—this is deflation.

Governments, central banks, and financial professionals worldwide rely on the CPI data to make crucial policy decisions, adjust social security benefits, and structure labor contracts.

Nominal Value vs. Real Value: The Crucial Distinction

Before we dive into how to calculate inflation rate using CPI, we must clarify the difference between Nominal Value and Real Value.

| Term | Definition | Impact of Inflation |

| Nominal Value | The face value of the money or asset (e.g., ₹1,00,000 cash). | Remains fixed, but its purchasing power shrinks. |

| Real Value | The inflation-adjusted value; the actual amount of goods/services the money can buy. | The only way to measure true wealth or growth. |

The inflation rate calculation is the bridge that converts misleading Nominal Value into critical Real Value.

The Core Formula: How to Calculate Inflation Rate Using CPI

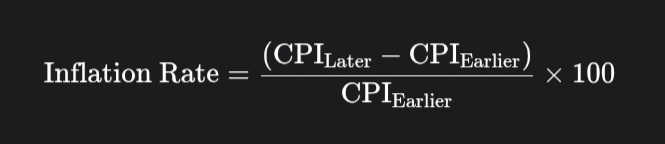

The inflation rate is calculated by determining the percentage change in the CPI between a starting period (CPIEarlier) and an ending period (CPILater).

Here is the precise formula used globally:

This formula ensures that the rate of price increase is measured relative to the price level at the beginning of the period, giving you the true percentage change.

Step-by-Step Mastery: Calculating the Inflation Rate Manually

Mastering how to calculate inflation rate using CPI manually is straightforward once you have the correct data. Let’s walk through the process using a hypothetical example to find the inflation rate over a five-year period.

Step 1: Gather Your CPI Data Points

The first and most critical step is securing the accurate CPI data for your desired start and end periods. For this example, we will use the annual average CPI index.

| Period | CPI Index Value |

| Later Period (CPILater, Year 2024) | 313.7 |

| Earlier Period (CPIEarlier, Year 2019) | 255.7 |

Step 2: Calculate the Absolute Change in CPI

Subtract the Earlier CPI from the Later CPI. This tells you the total numerical points the index has increased by.

Absolute Change = CPILater − CPIEarlier

Absolute Change = 313.7 − 255.7 = 58.0

This 58.0 represents the raw increase in the cost index over five years.

Step 3: Calculate the Percentage Change (The Inflation Rate)

Divide the Absolute Change (from Step 2) by the Earlier CPI (from Step 1), and then multiply the result by 100 to get the percentage.

Inflation Rate = 58.0/255.7 × 100

Inflation Rate ≈ 0.2268 × 100

Inflation Rate ≈ 22.68%

Interpretation of the Result

The calculation reveals that the inflation rate between 2019 and 2024 was approximately 22.68%. This means that, on average, the cost of goods and services increased by 22.68% during that five-year period, resulting in a corresponding decrease in your purchasing power.

Real-World Application: Why This Calculation is Critical

Knowing how to calculate inflation rate using CPI isn’t just an academic exercise—it is essential for managing your financial future. The calculated inflation rate underpins the ability to determine real value across diverse applications.

1. The Investor’s True Return: Measuring Real Growth

For investors, the most dangerous form of blindness is ignoring inflation. Your investment reports show Nominal Value gains, but you must measure against the inflation rate.

- Scenario: Your mutual fund portfolio returned 35% over the five years from 2019 to 2024.

- The Calculation: The inflation rate over that time was 22.68% (as calculated above).

- The Reality (Real Return):

Real Return = Nominal Return − Inflation Rate

Real Return = 35% − 22.68% = 12.32%

Your actual gain in purchasing power was only 12.32%. If your investment had returned 20%, you would have lost real value. This calculation is non-negotiable for long-term wealth creation.

2. Salary Negotiation and Compensation: The Real Paycheck

When negotiating a salary increase, the inflation rate is your most powerful piece of evidence. If you haven’t received a raise in three years, your Nominal Value pay has remained the same, but your Real Value pay has decreased significantly.

- Actionable Step: Calculate the cumulative inflation rate since your last raise. Use that percentage to determine the absolute minimum increase needed just to maintain your current purchasing power. Any raise below this rate is effectively a pay cut.

3. Historical Research and Planning: The True Cost of Living

For historians, students, and family researchers, the money value over time calculation puts economic history into perspective.

- Example: If you want to know the real value of a ₹10,000 retirement goal set in 2000, you need the inflation rate since then. This knowledge informs better current saving strategies.

- The Importance of Real Value: Comparing the cost of a university education today to a generation ago only makes sense when both are converted to a single reference year’s Real Value using the CPI.

💡 Automating the Calculation: The Power of the CPI Inflation Calculator

While knowing how to calculate inflation rate using CPI manually is crucial for understanding, performing this calculation repeatedly, especially across varying date ranges, can be tedious and prone to error.

This is where specialized tools shine. The CPI Inflation Calculator simplifies this entire process for you instantly.

Why Use the Tool for Instant Real Value

The dedicated CPI Inflation Calculator at ImageConvertHQ handles all the complexity behind the scenes:

- Data Source: It instantly accesses the necessary historical CPI data for the years you select (covering the critical 2000-2025 period).

- Formula Application: It applies the exact percentage change formula accurately every single time.

- Instant Result: It provides the inflation rate and the final real value (adjusted for purchasing power) in a fraction of a second.

- Clarity: It clearly displays the Nominal Value vs. the Real Value so you can immediately grasp the impact of inflation.

Instead of hunting for CPI data and manually plugging numbers into the formula, you just input the Initial Amount, select the Start Year, and select the End Year. The calculator does the rest.

Stop calculating and start analyzing! Click here to use the tool and instantly find the real value of your money:

👉 https://imageconverthq.com/cpi-inflation-calculator/

Deeper Dive: The Limitations and Nuances of CPI

While essential, the CPI is not without its limitations. Understanding these nuances makes you a savvier financial reader.

1. Substitution Bias

The CPI market basket assumes consumers are static, but in reality, when the price of one item (like apples) rises sharply, consumers substitute it with a cheaper alternative (like oranges). The official CPI calculation can sometimes overstate the inflation rate because it may not perfectly account for this change in consumer behavior.

2. Quality Change Bias

The price of a new smartphone might be higher than last year’s model, but it also comes with significantly better features (camera, battery, processing speed). The higher price reflects both inflation and increased quality. Modern CPI attempts to adjust for quality, but it remains a complex challenge.

3. Hedonic Adjustments

To address quality bias, government agencies use “hedonic adjustments,” which attempt to separate the portion of a price increase due to pure inflation from the portion due to improved quality. This is an ongoing refinement to ensure the calculated inflation rate is as accurate as possible.

Despite these challenges, the CPI remains the best and most reliable standard for comparing money value over time.

Take Control of Your Financial Reality

Understanding how to calculate inflation rate using CPI is the defining skill that separates informed financial decisions from wishful thinking. You now know the core formula, the step-by-step process, and the profound impact that the inflation rate has on your purchasing power.

Every time you look at a historical price, negotiate a salary, or set a long-term investment goal, you must convert that Nominal Value into a Real Value benchmark. The simplest way to apply this crucial knowledge is by using a reliable tool that automates the access to CPI data and the complex calculation.

Don’t let inflation keep stealing your purchasing power!

Visit the CPI Inflation Calculator now and instantly convert past money into today’s real value:

👉 https://imageconverthq.com/cpi-inflation-calculator/

Start calculating your real value today and secure your financial future.

No responses yet